AI-powered Financial Assistants: The Future of Personal Finance

Discover how AI-powered financial assistants are transforming the way we manage our finances.

Abhinil Kumar

Author

Emerging trend of AI-powered personal finance assistants.

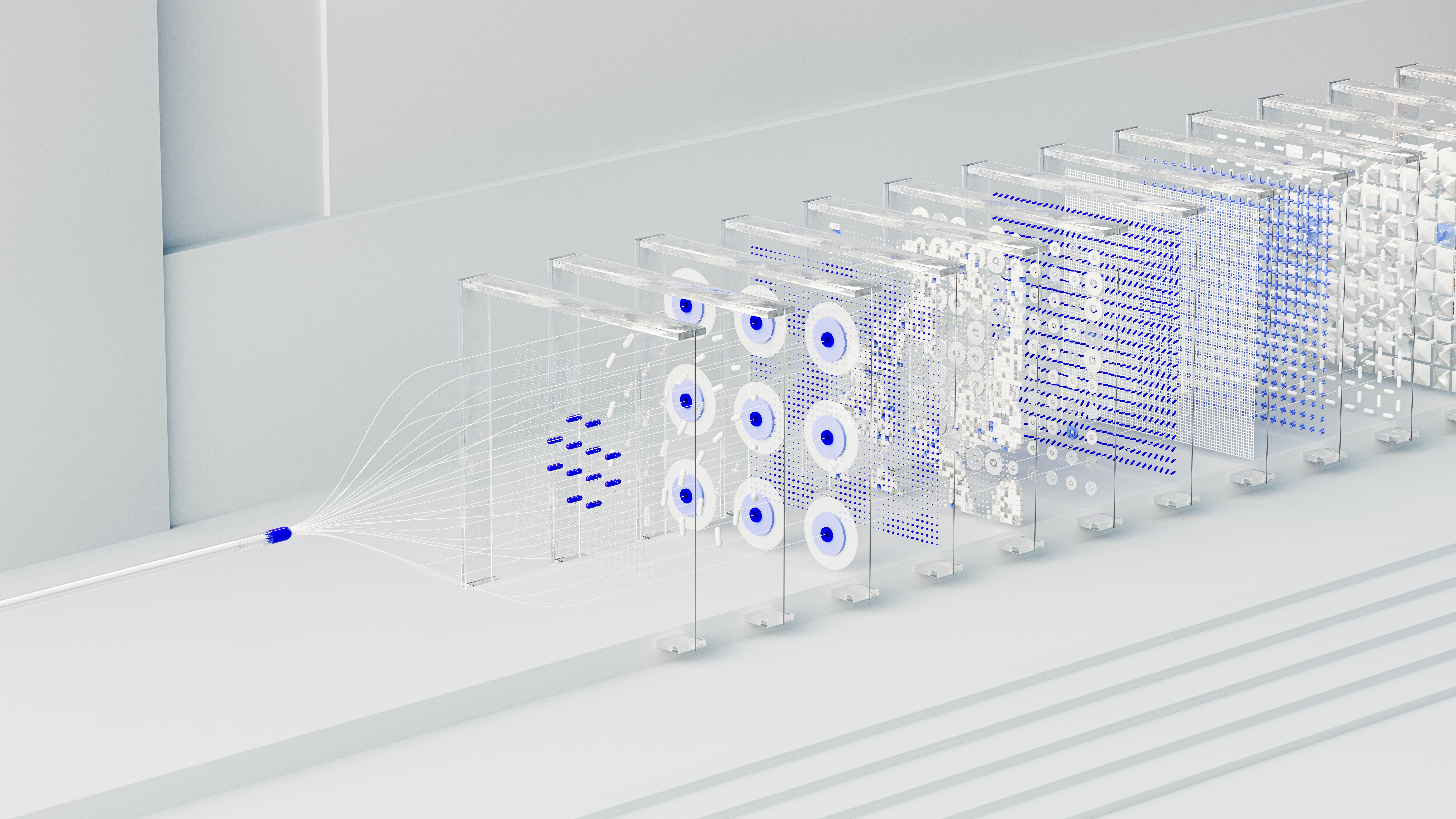

Personal financial management (PFM) is the management of a person’s financial assets, including income, expenses, savings, investments, and debt. Managing personal finances may be a difficult and daunting task, especially when there are so many bills to track and so many financial objectives to meet. However, recent artificial intelligence (AI) improvements have paved a clear path to optimizing personal finances. AI-powered systems can offer precise personalized actionable insights and recommendations to assist one in accomplishing their financial goals, from financial decision-making to credit score monitoring and personalized financial guidance.

Artificial intelligence (AI) has revolutionized various industries in recent years. Although the personal finance sector is still untouched, AI-powered personal finance assistants can emerge as a promising trend, transforming how individuals manage their money. These virtual assistants can keep track of all your expenses and ensure you pay them on time. They will input expenses into your accounting program, send reminders for due dates and payments, and confirm the accuracy of the billing information. These intelligent virtual companions can offer personalized guidance, automate financial tasks, and provide valuable insights, empowering users to make informed decisions and achieve their financial goals.

How virtual assistants can help individuals

AI virtual assistants can help individuals with budgeting, financial planning, investment decisions, retirement planning, tax advice, estate planning, and many other areas. They can analyze income and expenses, and create personalized budgets and financial plans tailored to the specific goals and circumstances of the user. They can also provide valuable insights and recommendations regarding investment decisions after performing meticulous analysis of the user’s preferences and market dynamics. They can also act as financial educators, providing relevant information and resources to enhance financial knowledge. Finally, they can help stay organized by sending reminders and notifications for important financial deadlines.

Privacy and security implications of using AI assistants

Although AI elevates personal money management and provides clients first-rate support, it also raises essential privacy and security implications. Ensuring the AI assistant you choose employs robust security measures to protect your sensitive information is vital. Data privacy is highly sensitive, and it is essential to understand how the AI assistant handles and stores your data. User authentication mechanisms should be in place to ensure that only authorized individuals can access your financial information. Vulnerabilities and risks should be addressed by reputable and trusted providers who regularly update and patch their software to address any security vulnerabilities. Third-party integrations should be reviewed to adhere to similar privacy and security standards. Consent and control should be understood to ensure that the AI assistant allows users to review, modify, or delete their personal information. Transparency and accountability should be provided to ensure that providers prioritize privacy and security.

Conclusion

The environment of managing personal finances and educating people about money is shifting due to AI. The ability to handle one’s finances at the touch of a button has replaced the complete reliance on physical banks and other financial institutions that individuals once had. People can better understand their finances and make better decisions using AI-based tools and solutions. Ultimately, the best method for long-term financial success will likely be to use AI-based solutions that can help users to make informed decisions and achieve their financial goals.