The Impact of Internal and External Taxes on the American Revolution: A Historical Overview

This guide explores the pivotal roles of internal and external taxes in the American colonies, highlighting how these financial impositions by the British Parliament without colonial representation fueled the American Revolution.

Abhinil Kumar

Author

Brief Overview of Internal and External Taxes in the American Colonies

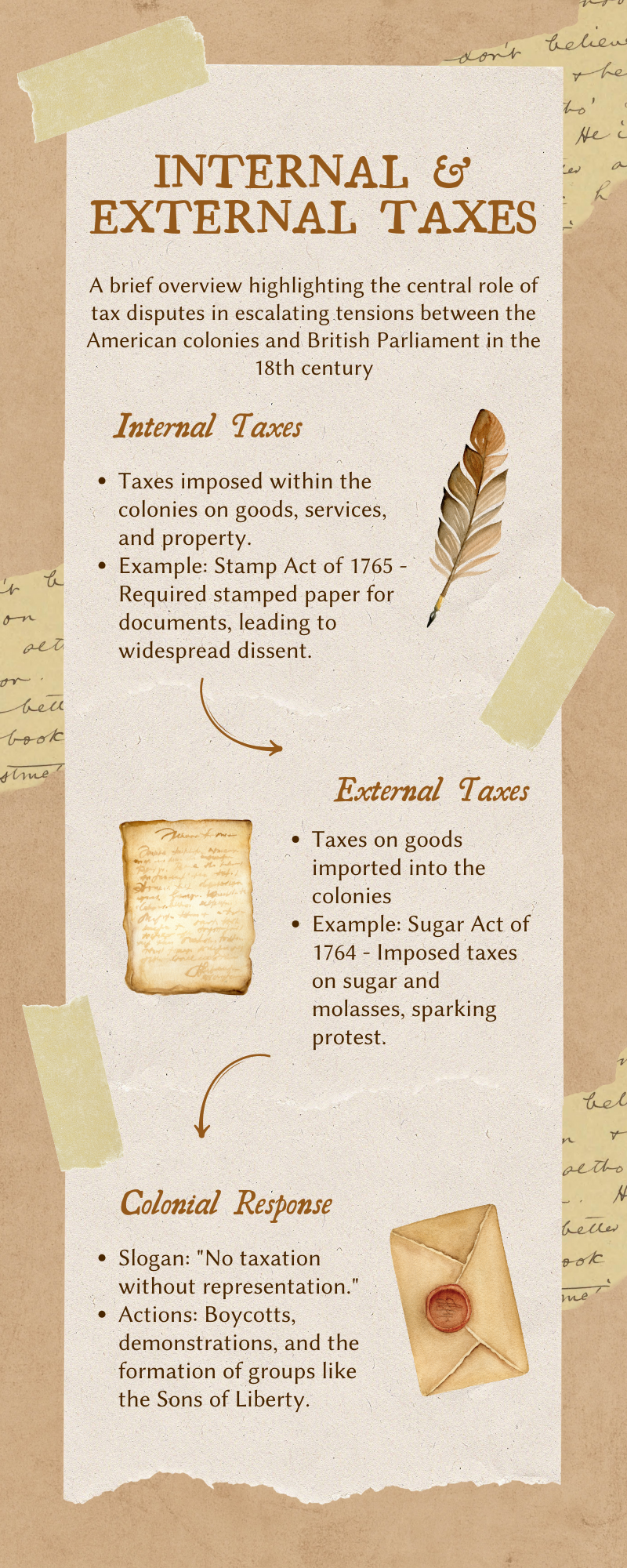

In the 1700s, the concepts of internal and external taxes became pivotal in the debate over the British Parliament’s right to levy taxes on the American colonies, laying the groundwork for American Independence. These discussions centred around whether the British policy of imposing taxes without colonial representation was justified. Internal taxes directly applied to goods and services within the colonies, and external taxes, levied on imports from Britain, were seen by colonists as unjust impositions by a government in which they had no voice.

Internal taxes are those imposed directly on goods and services within a particular jurisdiction or territory. In the context of the American colonies, internal taxes included taxes on property, income, and various goods produced within the colonies. These taxes were seen as a means for the colonial governments to raise revenue for local expenses.

On the other hand, external taxes were imposed on imported goods coming into the American colonies from other countries, particularly from Britain. These external taxes were levied on items such as tea, glass, paper, and other goods that the colonists relied heavily on daily. The most well-known example of an external tax was the Stamp Act of 1765, which required the use of specially stamped paper for various legal documents, newspapers, and even playing cards.

The significance of the debate over Parliament’s right to levy taxes lay in the colonists’ belief that they should have a voice in the decision-making process of the taxes that were imposed upon them. They argued that since they did not have representation in the British Parliamentary Authority, they should only be subject to taxation with consent. This led to widespread opposition, demonstrations, and, eventually, the American Revolution.

Internal Taxes

Internal taxes, also known as domestic taxes, are levies imposed by a government on various activities and products within its own jurisdiction. These taxes are an essential source of revenue for governments, enabling them to fund public services, infrastructure development, and essential welfare programs. Internal taxes differ from external taxes, such as customs duties or tariffs, which are imposed on goods and services imported or exported to and from a country.

Internal taxes can take various forms, including income taxes, sales taxes, property taxes, excise taxes, and value-added taxes (VAT). Income taxes are imposed on the earnings of individuals and businesses, with rates usually determined by income brackets. Sales taxes are levied on the sale of goods and services, often at a percentage of the purchase price. Property taxes are assessed on the value of real estate and typically fund local government services. Excise taxes are imposed on specific products, such as alcohol, tobacco, or gasoline, to discourage consumption or raise revenue. VAT is a consumption tax added to the price of goods and services at each stage of production and distribution.

Internal taxes play a crucial role in shaping a country’s fiscal policy, as they directly impact individuals, businesses, and the overall economy. The rates, exemptions, and structure of internal taxes can influence consumer behaviour, economic growth, and income distribution. Therefore, understanding and managing internal taxes are of paramount importance for governments seeking to achieve economic stability and social welfare.

How internal taxes were imposed on the American colonies

One significant example of internal taxation on the American colonies was the Stamp Act of 1765. This act required colonists to purchase and use special stamped paper for legal documents, newspapers, and various other printed materials. The revenue generated from the sale of these stamps would go directly to the English government. The Stamp Act was seen as particularly oppressive because it affected nearly all aspects of colonial life, from legal transactions to the dissemination of information.

The imposition of the Stamp Act was met with widespread resistance in the colonies. Colonists saw it as a violation of their rights, namely their right to be taxed only by their own elected representatives. The slogan, “No taxation without representation,” became a rallying cry for those who opposed the internal taxes imposed by the British government.

Examples of internal taxes, such as the Stamp Act and the Sugar Act

Internal taxes refer to taxes that are imposed within a country’s borders, typically on goods and services. The government levies these taxes to generate revenue and regulate trade. Examples of internal taxes include the Stamp Act and the Sugar Act, both of which played significant roles in American history during the colonial era. The British government implemented these acts, sparking controversy and increasing tensions that would eventually lead to the American Revolution. Understanding the impact and significance of these internal taxes provides valuable insight into the economic and political conditions of the time, as well as the grievances of the American colonists that ultimately led to their desire for independence. By examining the specific features and consequences of the Stamp Act and the Sugar Act, we can understand their historical significance and the lasting influence they had on shaping the course of American history.1

Reaction from colonists

In the wake of the enactment of the Stamp Act, the colonists’ reactions ranged from outrage to defiance. The mounting resistance against the taxation without representation became increasingly evident throughout the colonies. One notable figure among the colonists who voiced his opposition was Patrick Henry. His passionate speeches and resolutions submitted to the Virginia House of Burgesses played a crucial role in rallying the colonists against the Stamp Act.

Furthermore, the power of newspapers in spreading the message of discontent cannot be underestimated. Printers such as John Peter Zenger and Benjamin Edes used their platforms to publish critical articles and letters, raising awareness among the colonists and further fueling the resistance.

Boston, in particular, witnessed the emergence of a group known as the Sons of Liberty, who actively organized protests and demonstrations against the Stamp Act. Their actions included vandalizing the houses of colonial officials associated with the act and leading boycott campaigns against British goods.

The culmination of the colonists’ opposition came in the form of the Stamp Act Congress held in New York City in 1765. Representatives from nine of the thirteen colonies came together to voice their grievances against the act and drafted a petition to King George III demanding its repeal.

In response to the mounting pressure and growing unrest, the British Parliament eventually repealed the Stamp Act in 1766. This victory marked a significant turning point in the colonists’ fight for independence and was a testament to the power of unified resistance against unjust policies.

Internal and External Taxes

External Taxes

External taxes, also known as indirect taxes, are levies imposed on goods and services produced outside a country’s borders, that are imported into the country. While these taxes serve as a means for governments to generate revenue and protect domestic industries, their implementation is often limited due to various socio-economic and historical factors. This article delves into the concept of indirect taxes, explores their examples, and sheds light on the civil disturbances that followed their imposition.

Implementing external taxes presents several challenges. These include difficulties in accurately assessing the tax burden, potential negative impacts on international trade relationships, and the likelihood of creating a burden on domestic consumers. Additionally, external taxes often raise issues of tax evasion and smuggling, making it challenging for governments to enforce them effectively.

Explanation of what external taxes are and how they were imposed on the American colonies

External taxes, also known as import taxes or tariffs, are taxes imposed on goods that are imported into a country from another country. These taxes are typically levied by the government of the importing country to increase their revenue and protect domestic industries from foreign competition.

In the case of the American colonies, external taxes were imposed by the British government in an attempt to raise revenue and regulate trade. One notable example was the Sugar Act of 1764, which imposed import taxes on various goods, including sugar and molasses. The purpose of this act was to generate funds to support and maintain British troops stationed in the American colonies.

The American colonists saw the Sugar Act as an infringement on their rights, as it not only increased the cost of imported goods but also gave British customs officials greater authority to enforce trade regulations. This sparked widespread protests and boycotts and eventually contributed to the simmering tensions that led to the American Revolution.

Conclusion

The 18th-century British taxation policies, like the Stamp and Sugar Acts, were key in sparking the American Revolution, serving as symbols of the fight for autonomy and representation. The Stamp Act of 1765 and the Sugar Act of 1764 sparked widespread discontent and resistance among the colonists. This opposition wasn’t just a matter of finances but was deeply rooted in principles of autonomy and representation, echoing the broader discontent with British policy towards the colonies. The colonists, guided by leaders like Patrick Henry and supported by colonial agents who argued their case, rallied against what they saw as an overreach by British merchants and officials, demanding a say in the parliamentary taxation process.

The colonists’ fierce “No taxation without representation” stance and actions like the Sons of Liberty’s protests underscored their push for self-rule. The repeal of the Stamp Act was a milestone, yet it still needs to resolve the deeper issues, setting the stage for independence. These events underscore how taxes influenced political and social movements, embedding the quest for rights and self-governance in America’s foundation.