Smart Expense Tracking

Finally see where your money actually goes. One user found $487/month in forgotten subscriptions. Another cut restaurant spending by 40% without feeling deprived. Now it's your turn.

The Problem

You know you're spending too much, but where? That sinking feeling when your credit card bill arrives and you have no idea where your paycheck went. You've tried budgeting apps but gave up after a week of manual categorization.

Our Solution

Kniru reveals your spending story in seconds. Our state of the art AI analyzes every transaction, showing exactly where money leaks out. Filter spending views, exclude categories, and click any slice to see every transaction. Most users find an extra $500/month just in their first week of using Kniru.

How It Works

See how Kniru helps you uncover hidden spending patterns and find instant savings opportunities

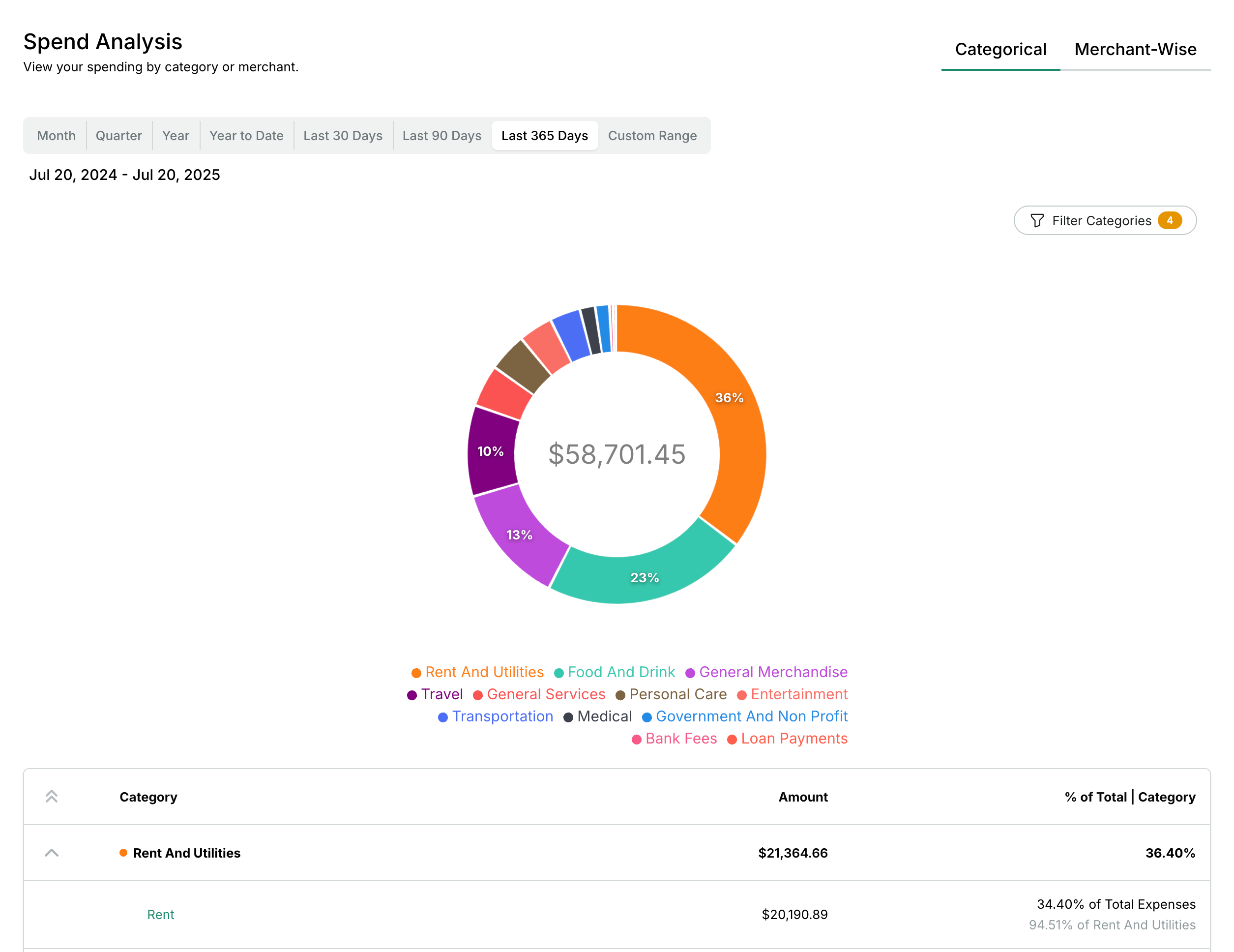

The $58,701 Reality Check

Right after linking your accounts, you'll see you the complete picture of your expenses down to every single penny just like one of our users who found the complete breakdown of her $58,701 over the last year.

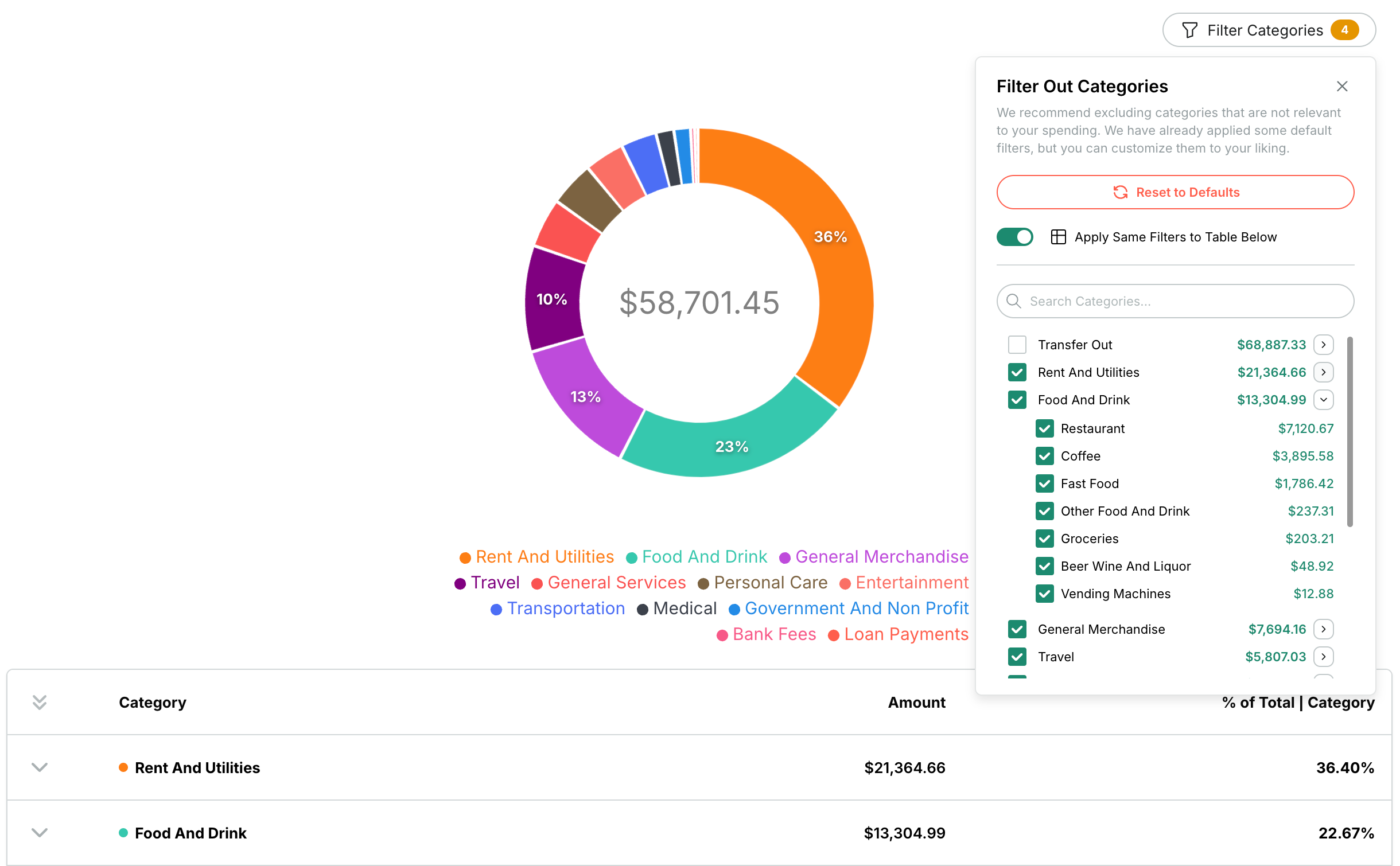

The Power of 'Show Me Everything Except...'

Because every story is different, we give you full controls. Start with our powerful defaults and adapt to your needs. If you don't like seeing your rent and only care about controllable spending, simply filter down to the necessities.

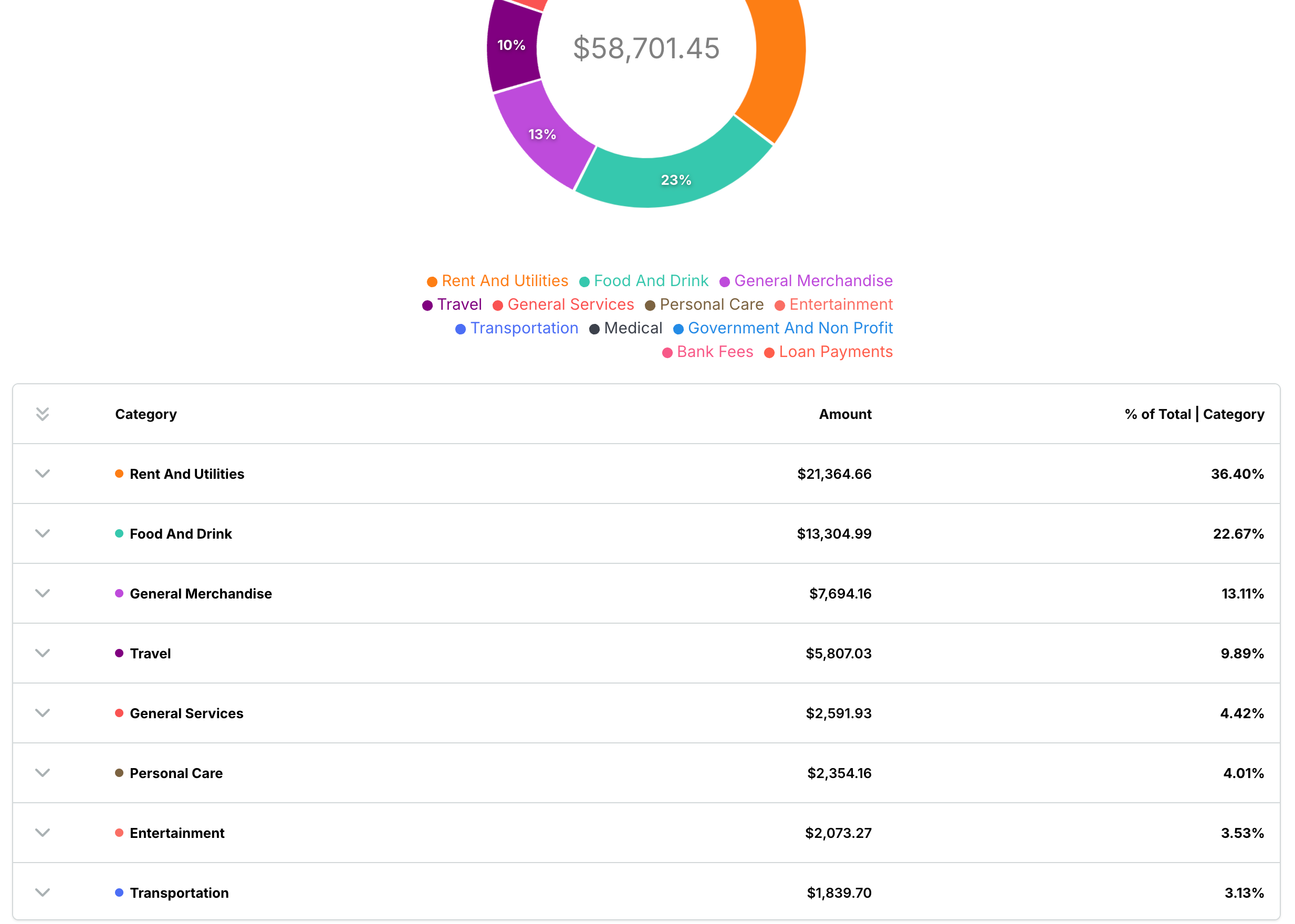

A picture is worth a thousand words - but sometimes you need more.

After taking a look at your spending pie chart, you can dive deep into any category and its subcategories with the tabular view for a deeper analysis with percentages and amounts for each.

Click, Discover, Save (Most Powerful Use-Case)

Click any category to see every transaction that contributed to the total amount in the chart. That's how people find unexpected spending, spot pricing increases, and discover wasteful spending.

Why thousands of people chose Kniru for managing their expenses

Experience the most powerful expense tracking with features that help you understand where your money goes down to every penny.

92%+ accurate AI categorization

Kniru correctly categorizes transactions with industry-leading accuracy. Categories with less confident are highlighted for you to recategorize with a single shortcut.

Reinforcement Learning for better categorization

Kniru uses RL to improve its categorization accuracy over time. With each recategorization, Kniru learns and does better for your future transactions.

Smart filters reveal hidden spending

Filter out fixed costs like rent to focus on controllable spending. See exactly where you can cut back without affecting your lifestyle.

Visual insights, actionable data

Pie charts show the big picture. Detailed tables show every transaction. Toggle between views to understand and take action.

Click any category to drill down

One click reveals every transaction in a category. Find forgotten subscriptions, duplicate services, and instant savings opportunities.

Track spending over any time period

Compare months, quarters, or custom date ranges. See seasonal patterns and track if temporary spikes became permanent habits.

Real People, Real Savings, Real Stories

Feedback from some of our users who love the spend analysis feature.

"Okay, this is embarrassing but I had no idea I was spending $1,200 a month on DoorDash! Now I meal prep on Sundays and only order when I'm genuinely too tired to cook. Saving $900/month feels pretty good."

Mike Chen

Software Engineer

"My husband swore he wasn't spending much. Then we looked at the breakdown together - $400 at Home Depot every month for 'small projects.' We laughed so hard. Now we actually talk about purchases over $50."

Jessica Martinez

Nurse

"Found a gym membership from 2019 😅 Plus like 13 other subscriptions I totally forgot about."

David Park

Teacher

Your Most Common Questions

The most common questions we get asked about our spend analysis feature.

Kniru achieves an unparalleled, over 92% accuracy with AI categorization. It also highlights the categories that it has less confidence in, so you can recategorize them with a single shortcut when needed. With each recategorization, Kniru learns from your feedback for similar transactions in the future.

Unlike other apps that force you to recategorize hundreds of transactions one by one, Kniru lets you bulk-edit entire categories. See 50 Starbucks transactions labeled as 'Shopping'? Fix them all in one click. Plus, Kniru learns from your corrections - fix it once, and it remembers forever.

Your data is encrypted end-to-end and never sold. We make money from subscriptions, not selling your midnight snack habits to advertisers. Your secrets are safe with us. Read more about our privacy values.

Zero guilt, 100% clarity. We don't send shame notifications or judge your choices. Instead, we show opportunities: 'You spent $200 more on groceries this month, but $300 less on restaurants - nice trade!' Users save an average of $500/month not from budgeting, but from awareness.

Ready to Find Your Hidden Money?

Join thousands of people who discovered they're not bad with money - they just couldn't see where it was going. Most users find an extra $500/month just in their first week.